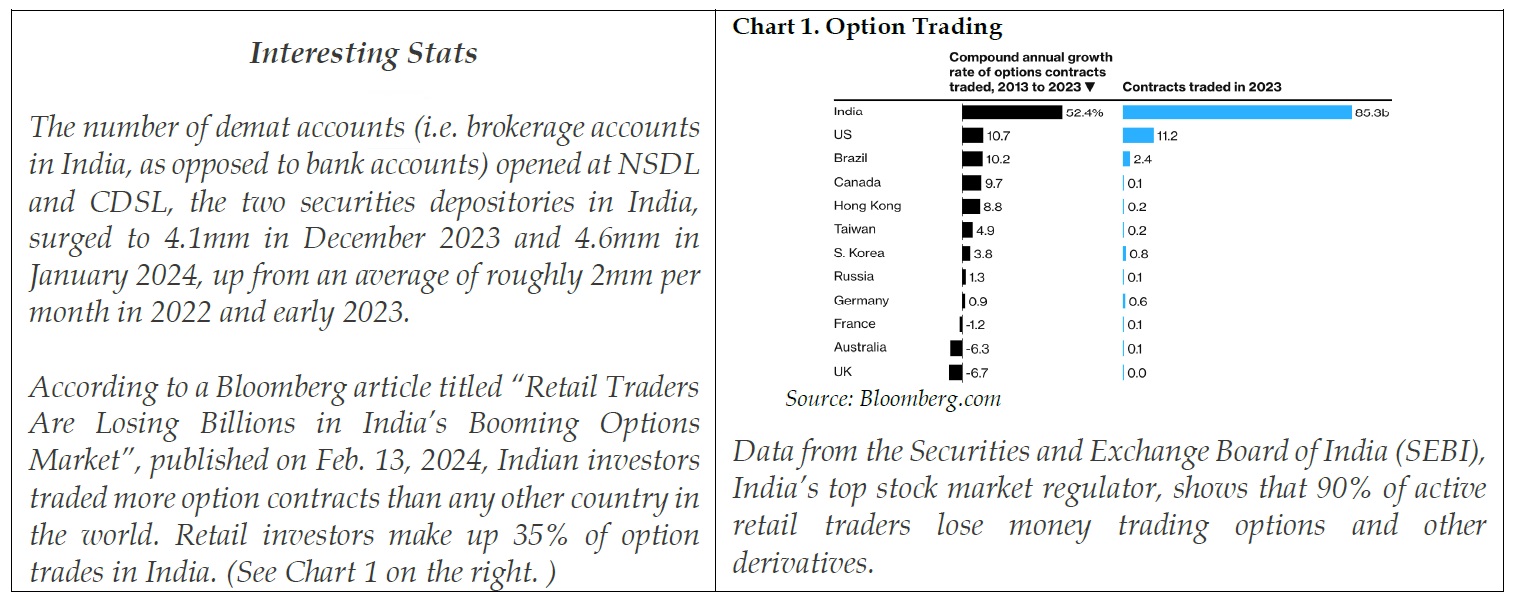

A top-down view of the India stock market based on a conversation with our on-the-ground team in Mumbai.

Based on anecdotal evidence from our brokers, retail trading reportedly comprises 90% of daily option trading activities, leaving mutual funds and foreign institutional investors accounting for the remaining 10%. As a result, retail investors often hold significant sway over the stock market. By analyzing option data, fundamental and institutional investors can assess market sentiment and adjust their portfolios to manage risks, including the risk of short squeezes.

Curb the Enthusiasm

The RBI has been trying to curb household leverage via higher risk weights in consumer credit lending at banks and NBFCs (Non-Bank Financial Companies), as well as risk weights of bank lending to NBFCs. This should help to promote healthy financial markets in the long run, but in the meantime has restricted growth at NBFCs. Retail investors’ enthusiasm may be further capped if authorities impose higher taxes

on capital gains and/or net worth hurdles for option investments.

Personal loan growth slowed down in the beginning of 2024 but still remained at elevated levels. Contrary to the market consensus for a first rate cut sometime in the second half of this year, we think the central bank may hold the rates steady for longer, until excessive personal loan growth is further contained.

Made-in-India

If Narendra Modi is re-elected, which appears probable, the focus for the upcoming five years would likely be on infrastructure spending for railways, defense, and logistics, aiming to achieve the “Made-inIndia” initiatives.

In order to strengthen its manufacturing sector and boost exports, India must compete effectively with other global players in terms of manufacturing and finished goods costs. Addressing inefficiencies, particularly in power and freight, is imperative for India's economic competitiveness.

Firstly, focusing on freight, Modi’s National Rail Plan 2030 aims to revolutionize India’s railway infrastructure. Anticipated moves towards privatization of railway stations in the coming year are on the horizon. Additionally, plans to build separate corridors to serve different sectors and realize cost savings are also in consideration.

Secondly, in the realm of power, the government has been committed to providing electricity to all citizens. The upcoming manifesto is expected to include a pledge for an around-the-clock power supply. With manufacturing and residential power demands set to surge and power availability nearing peak utilization, the government's focus on renewable energy is becoming increasingly crucial. Expect announcements of new projects, both in thermal and renewable energy, within the next couple of years.

Thirdly, with geopolitical risks escalating globally, the government is prioritizing defense indigenization and self-reliance in defense manufacturing.

While these are top-down opportunities, bottom-up analysis reveals that much of this potential is already priced in. That said, corrections in the market, such as the one occurred in March, can always present entry opportunities.

China+1

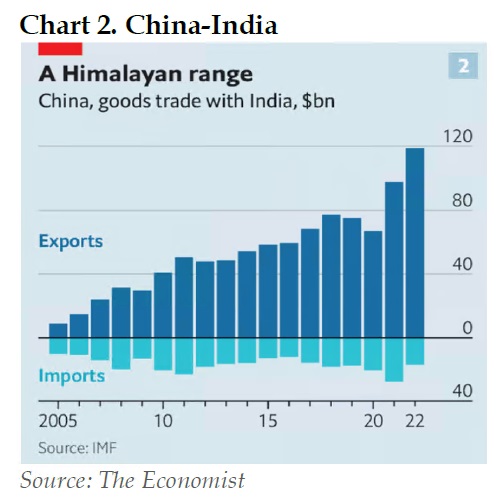

Despite the diplomatic and border tensions, the economic ties between India and China actually strengthened, evidenced by record level of bilateral trade activities in the past two years.

The chart on the left shows that China exports to India reached nearly US$120bn in 2022. In 2023, according to the United Nations Conference on Trade and Development (UNCTAD), India’s trade dependence on China continued to increase.

Unbeknownst to many, as one of the world’s top generic drug suppliers, India sources more than 50% of essential pharmaceutical ingredients from China. Also, according to Nomura, China’s exports to India consist of about 70% in capital goods, mainly in electrical machinery and equipment as well as nuclear reactors, boilers, machinery and mechanical appliances.

In our opinion, it would be hard for Modi’s government to achieve its infrastructure development plan without keeping China as a key business partner.

DISCLAIMER:

This document contained is confidential and proprietary and provided strictly for informational purposes only and is not complete and does not contain certain material information about making investments in securities. This document is intended for Professional Investors and/or Institutional Investors ONLY as defined in the relevant jurisdiction. It is not an offer, recommendation or solicitation to buy or sell, nor is it an official confirmation of terms. It is based on information generally available to the public from sources believed to be reliable. Any offering is made only pursuant to the relevant offering document, together with the current financial statements of the relevant fund, if available, and the relevant subscription application, all of which must be read in their entirety. No offer to purchase securities will be made or accepted prior to receipt by the offeree of these documents and the completion of all appropriate documentation. Before making any investment decision or otherwise acting upon information contained or referred in this document, you should seek independent professional advice.

No representation or warranty, expressed or implied, is made as to the accuracy or completeness of the information contained in this document, and nothing contained herein is, or shall be relied upon as, a promise or representation or that any returns indicated will be achieved. Changes to assumptions may have a material impact on any returns detailed. This document does not purport to contain all the information that may be required to evaluate the proposed transactions and you should obtain a copy of the final products particulars and any other relevant information before making an investment. Price and availability are subject to change without notice. Additional information is available upon request.