As investors poured more capital into these strategies, the performance of small stocks soared, perpetuating a self-reinforcing cycle. Despite this, the liquidity risk associated with such strategies has been mounting but largely overlooked.

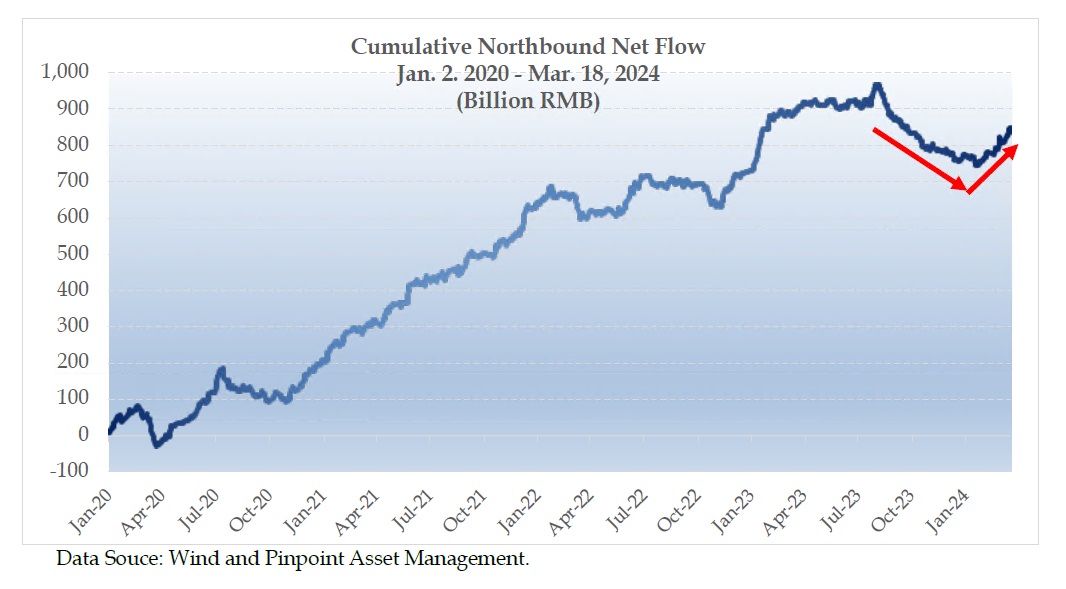

In the meantime, foreign investors were retreating from China’s stock markets amid heightened geopolitical and economic uncertainties. These investors, predominantly institutional and long-only in nature, tend to favor large-cap, high-quality names. Consequently, their exit has bolstered the outperformance of China's quant strategies over traditional fundamental players.

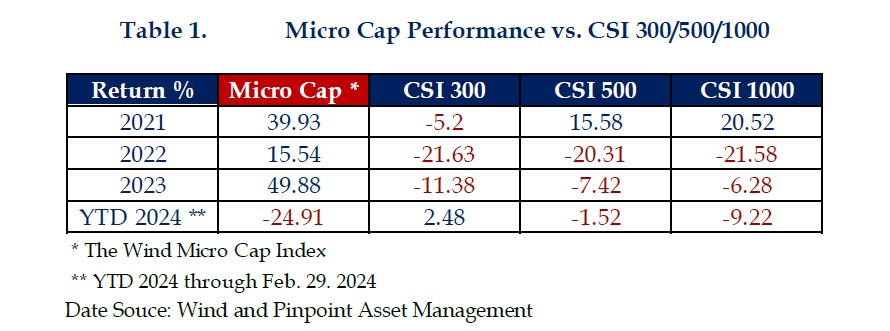

However, the landscape took a drastic turn in 2024. The relentless decline in China's broader stock market prompted intervention from the "National Team" to avert a financial system crisis, focusing primarily on the large-cap segment. Consequently, quant strategies find themselves in a precarious position, compelled to cover shorts and liquidate long positions, resulting in losses on both fronts.

The recent “quant crisis” episode is likely to prompt investors to reassess the riskiness of quant strategies, potentially shifting their focus back to fundamental approaches. Chinese stocks have already reached attractive valuation levels, and signs indicate that the recent capital outflow, notablely observed since last August, has stabilized by late January (Please refer to the chart below for cumulative northbound net capital flow since 2020). In our view, fundamental strategies are wellpositioned to capitalize on this shift.

As for China quant strategy, it may just be a matter of time before investors move beyond the recent fiasco and re-engage. Of course, the strategy itself will need to evolve to adapt to changing market conditions.

DISCLAIMER:

This document contained is confidential and proprietary and provided strictly for informational purposes only and is not complete and does not contain certain material information about making investments in securities. This document is intended for Professional Investors and/or Institutional Investors ONLY as defined in the relevant jurisdiction. It is not an offer, recommendation or solicitation to buy or sell, nor is it an official confirmation of terms. It is based on information generally available to the public from sources believed to be reliable. Any offering is made only pursuant to the relevant offering document, together with the current financial statements of the relevant fund, if available, and the relevant subscription application, all of which must be read in their entirety. No offer to purchase securities will be made or accepted prior to receipt by the offeree of these documents and the completion of all appropriate documentation. Before making any investment decision or otherwise acting upon information contained or referred in this document, you should seek independent professional advice.

No representation or warranty, expressed or implied, is made as to the accuracy or completeness of the information contained in this document, and nothing contained herein is, or shall be relied upon as, a promise or representation or that any returns indicated will be achieved. Changes to assumptions may have a material impact on any returns detailed. This document does not purport to contain all the information that may be required to evaluate the proposed transactions and you should obtain a copy of the final products particulars and any other relevant information before making an investment. Price and availability are subject to change without notice. Additional information is available upon request.